Translating deep thinking into common sense

How Intellectual Property Rights Address Economic “Scarcity”

By Stuart K. Hayashi

February 18, 2018

SUBSCRIBE TO SAVVY STREET (It's Free)

Too many “libertarians,” who proclaim themselves to be the champions of free enterprise and peaceful entrepreneurship, try to denigrate the enforcement of intellectual property rights as misguided at best and hateful at worst.

When it comes to the issue of the legitimacy of intellectual property rights (IP rights or IPRs) we witness an odd reversal. Even many of the most diehard proponents of the regulatory-entitlement state, such as Miami Herald columnist Leonard Pitts, Jr., recognize that an inventor holds rightful ownership of her invention and that an artist must retain rightful ownership over her artwork. Conversely, too many “libertarians,” who proclaim themselves to be the champions of free enterprise and peaceful entrepreneurship, try to denigrate the enforcement of intellectual property rights as misguided at best and hateful at worst. Like socialists, these supposed defenders of free entrepreneurship propound that artworks and original designs for inventions ought to be in a public domain, a commons. To these libertarians, such a proponent of the regulatory-entitlement state as Leonard Pitts is not contradicting himself in upholding the right to copyright, but is being entirely consistent in his support for expansive government. Indeed, these libertarians presume IPRs to be an unwelcome intrusion into the market on the part of the State on behalf of corrupt, rent-seeking copyright holders and patent holders.

According to the image fostered by those who condemn IPRs, we are to believe that patents are legal claims of exclusive ownership over vague general ideas that anyone can pull out of thin air. Worse, they add, the entire notion of intellectual property is unwarranted, as economics demonstrates that the institution of private property rights can only validly address entities which are “scarce,” and that only units of tangible objects—that is, objects consisting of matter, such as metals and trees—can be “scarce” in this manner.

The essay you are about to read shall rebut the following misrepresentations of IPRs on the part of their opponents.

- Intellectual property rights are a claim of ownership over a vague general idea for a category of marketed product, and patents grant to the party a government-enforced monopoly over an industry.

- Multiple parties working independently, each unbeknownst to one another, can—by coincidence—arrive at the exact same invention at the exact same moment. Yet the patent on this invention is awarded to but one of those parties. As the party receiving the patent holds a government-enforced monopoly, the process cheats the other parties that arrived at this same invention simultaneously.

- The misunderstanding most pertinent to this essay: The proper basis for recognition of private property rights is that there are some objects that are “scarce,” meaning that the present number of units of such objects is finite. Yet there is no pre-existing scarcity to a design that is copyrighted or patented. If you, as a filmmaker, copyright your motion picture and I make an unauthorized duplicate of it, you have not lost the original print. Nor have you lost the ability to make additional units of your copyrighted motion picture. “Scarcity” is inapplicable to designs that are patented or copyrighted, and therefore privatization of them cannot be legitimate. Furthermore, it is actually the institutionalization of patents and copyrights that imposes an artificial scarcity in the market, as the party possessing a patent or copyright can invoke the IPR in court to restrict the number of units of products that are based on her design.

Drawing from such misunderstandings about IPRs, too many self-professed libertarians castigate the possessors of copyrights and patents. To such libertarians, the possessors of copyrights and patents are not productive creators of wealth, but a class of rent-seekers upon whom the regulatory-entitlement state confers special privileges.

It is tragic when people who purport to defend free markets and who claim to value the creation of wealth would disparage intellectual property rights and their possessors in such a fashion, as the recognition of intellectual property rights is integral to the process of the creation of new wealth that innovation entails.

The Myth of “IP as Monopoly”

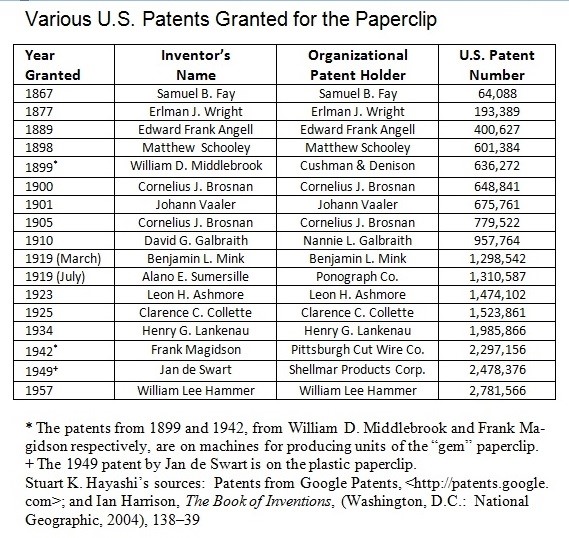

Let us first address the misconception that IPRs are monopolistic. Imagine, for instance, that in 1877 someone named Erlman received a U.S. patent on an invention as simple as the paperclip. We are to believe, then, that Erlman claims ownership over the whole general idea of “paperclip.” Hence, Erlman has gained a government-enforced monopoly on the production of paperclips. The whole industry is under his iron fist. Should someone else—say, a man named Mr. Angell—dare to produce and sell paperclips of his own, the patent enables Erlman to sue Mr. Angell into oblivion. Either Mr. Angell agrees to pay royalties to Erlman—extortion—or Mr. Angell must cease and desist. The patent specifies that Erlman can go on with this racket for seventeen years.

To the opponents of intellectual property rights, this is horrendous, and exactly why patents ought to be abolished.

Now let us look into the actual history. Since the late nineteenth century, in the USA alone there have been many patents on the paperclip, often granted in intervals shorter than seventeen years. That is, prior to one party’s paperclip patent expiring, a patent on yet another paperclip would be granted.

The reason for this is that a patent is not a claim of ownership over a general idea or a whole category of product. A utility patent protects the aspects of your specific original design for a product pertaining to how that product functions. A design patent, on the other hand, protects the aspects of your specific original design for a product pertaining to that product’s aesthetic qualities. When George Lucas obtained a design patent on his “Boba Fett action figure,” for example, it meant that you would need to obtain George Lucas’s permission if you were to produce a toy that carried an obvious deliberate likeness to the character of Boba Fett from The Empire Strikes Back and Return of the Jedi.

Your receiving a patent on your paperclip does not preclude others from patenting or selling their own paperclips. When a patent is granted on a paperclip, the patent is not on the general idea of having a device that holds more than one sheet of paper together. Nay, the patent is on a specific original aspect of the design. The reason why there are so many patents on paperclips is that different designers have made them from different materials, arranged them in different shapes, and employed new methods of producing units of paperclips in bulk quantities.

Another common straw man cited in attempts to discredit patents is the claim that several separate parties, completely unbeknownst to each other, can each come up with the exact same invention at the exact same time. This notion, too, stems from a misunderstanding. Many parties, each working independently, can each arrive at the same general idea at separate times that are within relatively close proximity to one another, yes. And that general idea is not what they patent. Each of those parties arrives at a different specific design, and each party’s patent has features distinct from the others’. A party patents not a general idea, but instead patents its own unique new method for implementing that idea. All the while, there remain myriad different methods whereby this idea can still be implemented.

Where two separate parties’ patents are similar—where there is “overlap” in their function-related features—the common result has been for those separate parties to pool their patents in a single trust. That was the result when Jack Kilby devised one aspect of the integrated circuit at Texas Instruments whereas, at Fairchild Semiconductor, Robert Noyce concentrated more on the process of wiring up the integrated circuit’s components. None of that evinces anything unjust about the principle of intellectual property as such.

The economic value that a homesteader wrings out of a patch of land is an emergent property. Emergent property refers to what happens when, once the raw materials are arranged in a particularly fortuitous fashion, some new (sometimes even wholly unprecedented) phenomenon occurs. For example, there was a time when there was no life on Earth; for billions of years, it was the same old chemicals lying around. But one day, those same chemicals were arranged in a new fashion, and what was nonliving matter became the first primitive living matter, some proto-micro-organism.

When Jack Northrop received his patent on his “flying wing” design for airplanes (U.S. Patent No. 2,406,506), that did not grant him a government-enforced monopoly on the production of airplanes; other parties still designed and patented their own aircraft. Not even the Wright brothers had a patent on the general product category of “airplane”; their patents were on the method of steering. Their innovation was steering the airplane by means of warping the shape of its wings. This did not stop their competitor, Glenn Curtiss, from making his own airplanes. Before the Wright brothers’ patents expired, Curtiss patented the manner in which he arranged the ailerons to be placed on airplanes’ wings. Ailerons are fins on the wings of airplanes that change direction in unison and thereby change the direction in which the airplane is to head. (The Wright brothers did ultimately use ailerons, but their patents didn’t describe them in the same manner that Curtiss’s did.)

A general idea for a product can instantly pop into one’s head. As we shall revisit soon, there is no “scarcity” to such general ideas. But that general idea is not what is patentable. To obtain a patent, a party needs a detailed model. When I say model here, I do not mean a physical working model, such as a prototype. In the context of this essay, model refers to the patent-filer’s specific and detailed explanation of how his or her design can, in scientific terms, plausibly function as promised while operated by someone competent in the trade for which the design was produced. As the U.S. Commercial Code’s Subsection 112 phrases it, what is patentable is not the general idea for a new category of product but the “written description of the invention, and of the manner and process of making and using it,” that is “in such full, clear, concise, and exact terms as to enable any person skilled in the art to which it pertains, or with which it is most nearly connected, to make and use” that invention. That is, if you invent a new sort of furnace for steel-making, obtaining a reliably enforceable patent for it calls upon you to provide a detailed theoretic model (this often includes diagrams) for a furnace that produces steel as promised when operated by someone skilled in steelmaking. That is not something that can be pulled out of thin air or dreamt up overnight, and that has much to do with why patentable designs are so “scarce.”

What it Takes to Produce a Practicable Design Worthy of Patent

Consider Chester F. Carlson and the development of the xerographic photocopier—what is more conventionally known as a Xerox machine. He first came up with the general idea in 1934 working at a law firm. He found it tedious to transcribe documents by hand, and wished there was an effective low-cost method for making clear, legible duplicates of documents. He spent hundreds of dollars on equipment (money he could have instead spent on other amenities, such as better housing) and hours of his life each week (hours he could have spent on earning money at a second job with steadier prospects for supplementing his income) to run experiments to test his theories on how this device could accomplish its intended task. It was not until 1938 when he finally finished a detailed theoretic model ready for patenting. This patent was granted in 1940.

Even then, nothing was easy for Carlson. He approached a multitude of capital-heavy corporations with his proposal to license this technology to them, hoping they would develop units of this device. Twenty of these big firms rejected Carlson’s pitch. It was not due to a lack of capital on their part; they had enough money to produce multiple units of Carlson’s design. Rather, for them the issue was that they judged that there would not be enough demand for this product to justify allocating their capital for this purpose.

Carlson’s fortunate break came in 1944 when Carlson finally was able to license the invention to the Battelle Memorial Institute. In 1947, Battelle turned over this technology to Joseph Wilson’s Haloid Corporation, a company whose name Wilson would change to Xerox.

It was not until 1949 that Xerox had developed a model it felt confident about putting on the market—the Xerox Model A. This ended up a commercial flop. Upon a cost-benefit analysis, the target market for this product—corporate offices, law firms, and schools—decided that this machine was not even worth renting. Joseph Wilson had to start over when searching for a method of producing a model that would satisfy marketplace demand adequately while remaining cost-effective for Xerox to manufacture. This led to the firm unveiling the Xerox 914 in 1959. This was the first model of a xerographic photocopier to generate a profit for any party. Carlson’s original patent had already expired before Xerox could profit from xerographic photocopying. Fortunately for Carlson and Xerox, Joseph Wilson was able to obtain patents on other design aspects on the Xerox 914 that the company had developed during its own R&D process. In the 1960s, royalty payments made Carlson one of the richest people in the country—well-earned.

Examine those durations. It took Carlson four years to develop a model that he could patent. The duration between Carlson’s initial inspiration and the introduction of any xerographic photocopier in any market was a whopping fifteen years. And the time it took between Carlson’s generation of the idea and the moment that this idea first generated a profit for any party was twenty-five years.

What happens in all those years? What happens is research and development and experimentation. In the four years it took Carlson to make his original vague general idea into a patentable model, Carlson had to purchase his own equipment to test his models to determine whether they functioned as he planned. Note that the equipment consisted of tangible goods—“scarce” units consisting of matter—that Carlson expended, used up, and depreciated.

The same grueling process of R&D and experimentation continued in the dozen years between the moment Joseph Wilson first gained access to this technology and the moment anyone profited from it. Xerox spent thousands of dollars employing engineers and technicians to run tests on how they could minimize costs while still producing units of this technology that were able to satisfy marketplace demand. To run such experiments, they too had to acquire tangible equipment coming in a finite number of units.

Yes, your patent is on something that is intangible—a model describing precisely in detail how a product is to be structured physically and how it is to function. But, by that same token, you would not have been able to come up with the intangible model if not for your using up tangible goods consisting in forms of matter that come in finite units. These are units that are, more often than not, relatively perishable.

How Intellectual Property Rights Do Address What Economists Call “Scarcity” of Units

Timothy Sandefur is among the many libertarian writers proclaiming that “scarcity” is absent in the case of designs and that, for this reason, they ought not to be protected by patents or copyrights. In his words,

In the case of tangible property, real or personal, … the property is naturally exclusive, meaning that if I have it, you simply cannot; if I take it, you no longer have it—you have been “disseised.” Intellectual property, however, is not like this. I can “take” it from you, and yet you still have it. If, for example, you are the greatest musician in the history of rock and roll (that is, John Fogerty) and you have written the greatest song ever (that is, “Born on The Bayou”…), then I can sing “Born on the Bayou” in my shower, and you can still, at the same time, use and enjoy your “property” as you wish: you can perform it, sell it, or leave it alone.

We will come back to this later: Sandefur’s example of singing a famous copyrighted song in the shower is a straw man. For now, note the frequency with which that argument is repeated by other opponents of intellectual property. To provide an example that sounds less tongue-in-cheek than Sandefur’s: if a filmmaker like Justine produces her own low-budget commercial motion picture, and I make an unauthorized copy of it, Justine is not deprived of the original print; she retains custody of it. That same idea comes across in this Facebook meme:

Sandefur’s misrepresentation derives from this statement from University of Chicago economist Arnold Plant:

It is a peculiarity of property rights in patents (and copyrights) that they do not arise out of the scarcity of the objects which become appropriated. They are not a consequence of scarcity. They are the deliberate creation of statute law, and, whereas in general the institution of private property makes for the preservation of scarce goods… …property rights in patents and copyrights make possible the creation of a scarcity of the products appropriated which could not otherwise be maintained [emphases Plant’s].

Here is a rephrasing of the argument that Timothy Sandefur and Arnold Plant present. Private property rights, primarily being the law’s method of resolving disputes over how finite resources are distributed and allocated, are applicable exclusively to tangible goods—that is, objects consisting of matter—that exist in a finite number of units. If apples and apple trees are commercialized, then private property rights apply to them. Metals count as well. If widgets are machines made for human consumption, then private property rights apply to them. As there is presently a finite number of units of widgets in existence, then if you acquire more units of widgets, that is fewer available for me. If you have more apples, that is fewer apples for me. I could grow my own trees and then graft my own branches on them to grow more apples (all apples on the market are clones from the same ancestral branch; wild apples grown from wild apple trees are not uniform in quality),more units can be produced in the future—this would take time and resource inputs—but the fact remains that in this precise moment, there is a finite number of units of apple trees and widgets in existence.

That is what economists conventionally mean when they say that economics is about “scarcity.” Note that when conventional economists say that markets address “scarcity” in this context, they are not necessarily conceding Rev. T. Robert Malthus’s premise that humans just use up nonrenewable resources and one day will be left with nothing. Rather, the economists just mean that there is presently a finite number of units on the market.

In the understanding of Arnold Plant and those who cite him, if there were no private property rights, then people would always be violently fighting over who gets what. Once private property rights are established, it reduces the risk that such fights will break out. Private property rights, in this interpretation, mean that you and I agree that this-and-that belongs to you, whereas this-and-this belongs to me, and we leave each other be.

Then those who argue in Arnold Plant’s vein, such as Timothy Sandefur, continue that because intellectual property rights are intangible, they cannot be authentic private property rights. This is question-begging on the part of too many of intellectual property’s detractors. To “win” their argument, these opponents of intellectual property decide that, from the outset, they have to define private property rights as referring exclusively to tangible goods that come in a finite number of units. Upon pretending that this arbitrary premise is some well-established fact, they then point out that intellectual property rights are intangible and that, by their own (arbitrary) definition of private property rights, patents and copyrights are precluded from being authentic property.

First, their conclusion is false, because the government’s attempt to resolve some potential dispute over the allocation of tangible goods is not the main justification for private property rights. The main justification is that you should maintain legal control over the very economic value that you have created. You deserve to maintain control over your art and inventions for the same reason that you, as a homesteader, deserve to maintain control over the patch of land that you have rendered inhabitable.

The economic value that a homesteader wrings out of a patch of land is an emergent property. Emergent property refers to what happens when, once the raw materials are arranged in a particularly fortuitous fashion, some new (sometimes even wholly unprecedented) phenomenon occurs. For example, there was a time when there was no life on Earth; for billions of years, it was the same old chemicals lying around. But one day, those same chemicals were arranged in a new fashion, and what was nonliving matter became the first primitive living matter, some proto-micro-organism.

Similarly, when a homesteader improves a plot of land—meaning she makes it inhabitable for human use—she is not creating any new matter; she is rearranging the matter that already exists. But this new arrangement has rendered this land, once previously uninhabitable, into land that is inhabitable. That habitability is the new phenomenon, the emergent property. It is also the new economic value created. That same principle applies to patentable inventions. The patent for a highly profitable invention is a set of instructions for arranging already-existing matter in a fashion that produces some effect that satisfies marketplace demand, and what makes this patent lucrative is that the patent’s instructions allow for a manufacturer to educe this demand-satisfying effect in a manner that is cost-effective enough to allow the manufacturer to sell units of this arrangement at a net profit. This invention produces a net increase in utility in the economy, utility that previously had not existed. That net increase in utility, that unprecedented economic value that has been created, is also an emergent property.

Both (1) a homesteader’s improvement in the land and (2) an inventor’s contribution of a net increase in utility, are emergent phenomena whereby new economic value has been created, economic value previously unexplored.

For the law to recognize this newly created economic value as being the private property of the party that created it does both of the following: (a) it justly allows the party that created this value to sustain itself while (b) it also signals to other market participants that they, too, will be free to reap the rewards of their own value creation if they, too, produce these new forms of utility.

[Tom] Palmer’s assumption is a straw man; Carlson has a rightful claim to his design for the same reason that a homesteader has a rightful claim to the plot of land she improved.

When someone such as myself points out that there is a “scarcity” component of the time and effort that inventors invest in their inventions and artists invest in their art, such opponents as Tom Palmer conflate our argument with Karl Marx’s labor theory of value. Karl Marx presumed that just because manual laborers directly interacted with factory machinery in their work that necessarily meant that the manual laborers had a stronger claim to the machinery than did the investors who purchased and legally owned the machinery. That is, manual laborers work hard with the factory machinery, and therefore the factory machinery is rightfully theirs. Tom Palmer and some other opponents to IPR would have their readers believe that we defenders of intellectual property are saying nothing better—that Chester F. Carlson rightfully owns the xerographic photocopier for no reason other than that he worked hard on it and therefore is right to use his oppressive government monopoly to thwart other entrepreneurs who wish to produce photocopiers independently of him. But Palmer’s assumption is a straw man; Carlson has a rightful claim to his design for the same reason that a homesteader has a rightful claim to the plot of land she improved.

Second—and this is what the arguments of Arnold Plant, Timothy Sandefur, and Tom Palmer conveniently elide—intellectual property rights do address the allocation and usage of tangible goods that are finite in number. Intellectual property rights do address what Arnold Plant calls “scarcity” and what Timothy Sandefur calls the fact that tangible goods, consisting of material substances and coming in a finite number of units, can be “disseised.”

Impractical ideas—ideas for products in which consumers express no interest—are ideas that come cheap. It took me mere seconds to think up the general ideas of “glow-in-the-dark sunscreen” and “edible toilet seats.” One does not invest any “scarce” resources in tossing around vague ideas for products that will not satisfy marketplace demand. By contrast, the designs which inventors and other entrepreneurs seek to patent are practicable designs. For the rest of this essay, the term practicable design refers to an original design for a product that is so practical that, if multiple units are produced from this design, parties would willingly pay money in exchange for access to these units, and this is on account of the units produced from this design functioning as intended. To develop such a practicable design is the opposite of cheap.

In the four years it took for Carlson to develop a xerographic photocopier model worthy of licensing, he had to acquire equipment for testing this model. That equipment came in the form of perishable tangible goods that always had, and always would, come in a finite number of existing units. As Carlson used up these goods in his experiments, they depreciated in value, meaning that if other people tried to use these units of goods afterward, they would not be able to derive as much value from those goods that Carlson could have derived.

The same principle applies in the twelve years it took for Xerox to produce a model of xerographic photocopier that satisfied enough marketplace demand to generate a profit. In its own testing, Xerox employed engineers and technicians running their own tests, again using tangible equipment that came in the form of units that would always be finite in number. For any firm to run its own tests in R&D, it must use up resources, and those are units of resources which other parties are not able to access. Even if those resources remain intact once R&D is done, those resources have usually depreciated, meaning the same value cannot be wrung out of them as was wrung when the R&D process began.

Arnold Plant and the anti-patent forces citing him have made the point that the very economic “scarcity” they believe to be private property’s main justification is what happens to be absent in the case of practicable designs. They point out that if I produce units from your practicable design in defiance to your wishes, that deprives you neither of your practicable design nor the units that you yourself have produced from that design. Yet Plant and those who cite him have overlooked an important aspect of the creation of those practicable designs. Producing those practicable designs involves using, depreciating, and destroying units of resources that are “scarce.” And, for that reason, the practicable designs that result from the process are “scarce” in number as well.

Note, again, Arthur Plant’s false assumption that while there is no built-in “scarcity” to practicable designs, the introduction of the patents to the legal system does impose an artificial scarcity, as a patent holder enforcing her patent can prevent other parties from introducing, into the marketplace, additional units of products cast from her design. Again, Plant says “patents and copyrights make possible the creation of the scarcity of the products appropriated which could not otherwise be maintained.” For his part, Friedrich August von Hayek just takes it for granted that Plant’s assessment of the situation is accurate: “it is not obvious that…forced scarcity is the most effective way to stimulate the human creative process.”

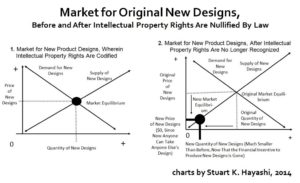

There is no scarcity of impractical ideas that, if implemented, would not satisfy any marketplace demand. But practicable designs that, when implemented, do satisfy marketplace demand, are scarce. And, contrary to the assumptions of Arnold Plant and F. A. Hayek, that “scarcity” was present prior to the passage of any laws concerning patents or copyrights. That “scarcity” is caused by economic law no less present or consistent than the laws of demand and supply.

The Tragedy of the Public-Domain Commons

Recall that before Carlson won a deal with the Battelle Memorial Institute, he approached twenty corporations for licensing and got rejected by each of them. Imagine what those twenty firms could have done if there was no intellectual property protection for the xerographic photocopier: once the Xerox 914 hit the market in 1959 and finally generated a profit for Xerox—after a quarter-century of being in development and profiting no one—those twenty corporations could have pirated that model with legal impunity.

Those who cite Arnold Plant would celebrate such piracy as wonderful because they proclaim that patent protection imposes an artificial “scarcity” on the number of units of xerographic photocopiers on the market. With the Xerox 914 having patent protection, Xerox did not even have to sell these units; organizational clients had to pay rent to use any units. By contrast, continues Arnold Plant’s reasoning, if the twenty corporations that rejected Carlson were able to pirate Carlson’s design, then that would put that many more units of xerographic photocopiers on the market by the early 1960s. The increased competition would lower prices; maybe Xerox Corporation would be motivated to sell units of the product rather than be stingy and only lease them.

Such an argument is shortsighted.

By pirating Xerox’s intellectual property, those twenty corporations would, in effect, be stealing the value of the net increase in utility in the economy — utility that previously had not existed — and the value of tangible goods that Carlson and Xerox needed to use up and depreciate in the process of developing the Xerox 914. Sandefur’s critique fails to acknowledge that this is what gets “disseised” when someone pirates intellectual property.

The four years that Carlson spent on his model would be for naught. The twenty-five years it took for Carlson’s idea to come to fruition, culminating in the first profitable xerographic photocopier, would be for naught. Would-be inventors who saw what happened to Carlson after twenty-five years of this work would be discouraged from coming up with their own practicable original designs for useful products.

If the law did not protect an apple grower’s right to the orchard he homesteaded, and anyone could trespass onto the orchard and pick off the apples freely, then in the long run there would be fewer apples grown. Likewise, if the law does not protect Chester F. Carlson’s right to have exclusive control over the model he produced, and any capital-rich corporation can pirate his model, then in the long run there will be fewer such practicable models being thought up by inventors. This will happen:

If an inventive party’s right to exclusive control over its own specific original design is not recognized by law because the design is not recognized as the rightful private property that it is, most inventors will be Atlases who “shrug.” The long-term consequence would be that far fewer units of new practicable designs will be placed on the market. Such units really will become “scarce”—scarce in that much darker, Malthusian meaning of the term, scarce as in rapidly dwindling in availability.

Artwork Also Cannot Be Created Without the Usage of Tangible Goods Coming in a Finite Number of Units

The same principle applies to the pirating of artwork. No matter how easy it is to duplicate an artwork, the original version of it was the product of many inputs of tangible goods that always existed as a finite number of units. If Justine uploads an image of a painting she did, it might take me a second to make a JPG or GIF of the image and pay her nothing for it. But the painting did cost Justine. She spent hours on that painting, hours she could have spent on a more secure form of employment. She inputted units of tangible goods—units consisting of matter—units that are finite in number. Natural resources went into the creation of the paints and brushes she employed; those are units of natural resources and paints that other people will not have.

The same principle would apply to someone who does professional-quality artwork in Photoshop or Microsoft Paint. It takes years of practicing one’s craft to reach that level of quality, and that is time one could otherwise spend on some steadier source of income.

Consider Justine making a feature-length motion picture that takes place in a haunted house—one that is very low-budget but which she intends should still be of professional quality, as she intends to commercialize it. Either she must construct the set herself or she must rent a set that was already constructed. Either way, that involves tangible goods that will always be finite in number. When Justine uses the set, other parties cannot use the set. When specific objects are added to the set to give it the needed ambiance, those objects are not being used by other parties. Maybe this process costs Justine and her investors $10,000, and they plan to recoup the costs by selling DVDs of the movie.

Now imagine people pirating this work, producing perfect digital copies of the movie and paying nothing to Justine and Justine’s investors. According to the argument of Timothy Sandefur and the meme about copying, no theft occurred. After all, Justine and her investors still have the set; they have not lost any of the props they purchased and which remained intact once shooting had been completed. That the movie was pirated does not deprive Justine and her investors of the original print of the movie.

Here, too, observe what the opponents of intellectual property overlook.

When various parties decide to pirate Justine’s movie and pay nothing for it, they are stealing the value of the tangible goods that Justine used up and depreciated in order to make the movie a reality. And once Justine and others like her realize that IP infringers have overwhelmingly obstructed them from recouping the costs they incurred from using up such tangible goods, such independently-but-still-professionally-produced feature-length commercial films will grow scarcer still.

When a designer puts out a work for commercial purposes, she does so on the implicit understanding that in any instance wherein another party obtains custody over another unit of this intellectual property, this is done with the permission of the IP holder. Normally such permission is granted on the condition that the IP holder receives the monetary compensation she set as her price.

Suppose I hire you to do manual labor for me. Then you do it. Then I refrain from paying you. This contractual breach would, in effect, involve me stealing the value of your time and labor—time and labor you otherwise could have spent on some other endeavor. In this instance, I benefited from the time and labor you invested, and you were left unable to recoup that investment when I skipped out on providing the compensation that was always part of the arrangement. Likewise, for me to pirate your IP is for me to benefit from the value that you invested into it, while you are left unable to recoup that investment when I skip out on providing the compensation that was always part of the arrangement.

To wit: making an unauthorized duplicate of Justine’s motion picture does not remove the master copy from her possession, but it does steal from her the value of the resources that Justine invested, consumed, and destroyed for the purpose of bringing about that motion picture and commercializing it.

And yet, even at this point, there are some opponents to IP who insist on conflating IP with protectionism and tariffs. The claim goes, Isn’t the securing of a party’s investment the very purpose of protectionism? If Chrysler demands tariffs against automobiles imported from Japan, isn’t this on the basis that Chrysler already invested lots of capital—fixed costs—on producing units of its product, and that, without tariffs, Chrysler’s ability to recoup its investment will be jeopardized?

Someone who advances such an argument would not be doing anything new, because this rationalization for undermining IP was common in the 1800s. It was advanced by a British Member of Parliament—John Lewis Ricardo, nephew of free-trade economist David Ricardo. As University of Chicago historian Adrian Johns phrases it, John Lewis Ricardo maintained that patents are “the equivalent, in effect, of the navigation acts or the Corn Laws themselves.”

It is true that, in both examples, filmmaker Justine and protectionist Chrysler are trying to protect their investments. Moreover, both Justine and Chrysler expect to be recompensed financially by customers who consume their respective products. The difference is this: If the absence of tariff enforcement allows Chrysler to go out of business, it is because no one bothered to consume any of Chrysler’s products in the first place. No one benefited from Chrysler’s products and that is why no one sent money to Chrysler. By contrast, if the absence of copyright enforcement causes Justine to go out of business, it was because many people enjoyed Justine’s movies but no one paid Justine the money they owed her for it. Those who conflate IP with protectionism ignore the fact that protectionism is about manipulating customers into purchasing inferior units and inferior substitutes they do not value and do not want to consume, whereas IP calls upon customers to pay the money they owe to the party whose contents those customers do value and do consume.

Notice How Opponents of IP Resort to Caricatures and Straw Men About IP Enforcement?

Let us go back to Timothy Sandefur saying, “If, for example, you are … John Fogerty … and you have written … ‘Born on The Bayou,” … then I can sing ‘Born on the Bayou’ in my shower, and you can still, at the same time, use and enjoy your ‘property’ as you wish: you can perform it, sell it, or leave it alone.”

The activity of singing in the shower is generally regarded as comical, and therefore this example might seem to be just levity on Timothy Sandefur’s part. Whether or not that was his main conscious intention, this statement of his happens to be misleading in a way very convenient for Sandefur and other opponents of intellectual property. It is convenient for their straw man. If you sing a famous song in the shower— off-key, as is common for those of us who are not professional musicians—and then the recording artist behind the song sues you over it, that would be rather petty on the part of the recording artist, would it not? On some level, opponents of IP recognize that their argument will fall apart if they do not patch together this straw man that caricatures enforcement of IP as generally something horribly petty.

In real life, no professional musician will sue you for singing his song in the shower. My father had paid gigs as a professional musician in his younger days, but I still sing off-key (my refusal to learn about music was part of my rebellion against him). No one is going to pay to hear me sing “Born on the Bayou” off-key. Fans of the song will still pay money to iTunes to hear the original recording of this song; my singing in the shower is not stealing any of the value of the tangible goods that were inputted when Creedence Clearwater Revival recorded the song. By contrast, if people make perfect digital copies of the original Creedence Clearwater Revival recording and pay nothing to the owner, that is stealing the value of the work of Creedence Clearwater Revival and the value of the sophisticated equipment, which could only exist in a finite number of units, operated in the effort to provide such a sharp recording.

Likewise, if a professional musician, who has had years of his own musical training, is paid to perform John Fogerty’s songs to packed houses without John Fogerty’s permission, that is stealing the value of the perishable tangible goods that John Fogerty had to use up as he wrote those songs. There would be nothing petty about John Fogerty having his lawyer send a letter to that professional musician.

Conclusion

Suppose you own a huge apple orchard. One night, I trespass onto the orchard and fill up just one basket with your apples. Before I leave, you catch me. I then reproach you for your self-righteousness. I point out, “You still have an entire orchard full of apples; I just took a basket’s worth. You still have the trees and the branches you grafted onto them. You can always grow more apples.” That defensive retort ignores all of the inputs for which you had to pay when growing your apples. Likewise, those who deny that the pirating of IP does harm are people who just as easily and conveniently ignore all of the “scarce” inputs for which the inventor had to pay in the effort to produce that IP.

The production of a patentable invention or copyrightable artwork is an arduous process into which “scarce” resources are inputted and invested, and we owe it to those who produce these designs that we recognize that they rightfully exercise legal control over the new value they have created. Those who profess to appreciate the originality that arises from free enterprise should understand that most of all.

This is a revised version of an essay originally published on Stuart K. Hayashi’s blog.